Educational Trust

Talk to an expert

449 241 6423

Education is the foundation of success in life

- Public universities do not have the capacity to meet the demand of all applicants.

- Las colegiaturas de las universidades privadas aumentan cada año, alcanzando en ocasiones hasta 30% de incremento.

- In addition to tuition, there are other expenses that must be covered, such as books, materials, workshops, and transportation, which can represent an additional 20% of the university tuition.

Educational Legacy

How can you plan your children's college education?

- Plan today with your income from your productive life for college with the actual cost when you turn 18.

- Manage those savings with a solid, expert financial institution that can help you increase your capital and ensure its efficient use.

- Provide financial support for your university studies, even if you miss school or become totally disabled.

How does it work?

An educational legacy releases the capital at age 18, either in a lump sum or in monthly installments over the next four years. The main advantage of the trust is that the transfer of the capital is not conditioned on whether the minor is in school or not; if the child does not complete their studies, the capital reverts to the parent or guardian.

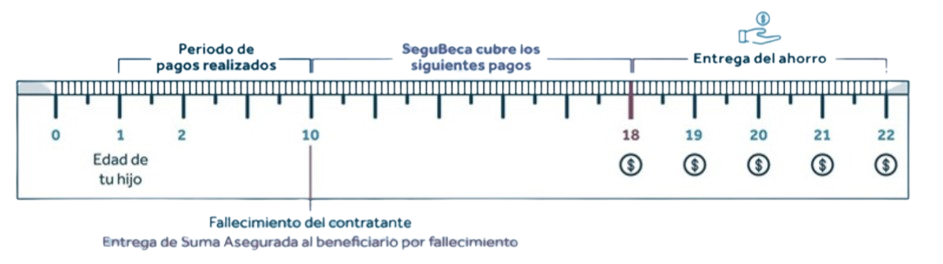

What if you were to miss?

- The insured amount will be delivered to the person you designate as beneficiary in the event of death.

There is no payment of remaining premiums no matter the year in which said event occurs

- If the minor dies before the age of 12, the policyholder is paid the annual premiums based on the year in which the event occurred, and if the minor dies before the age of 12, the insured amount contracted in the trust is paid.

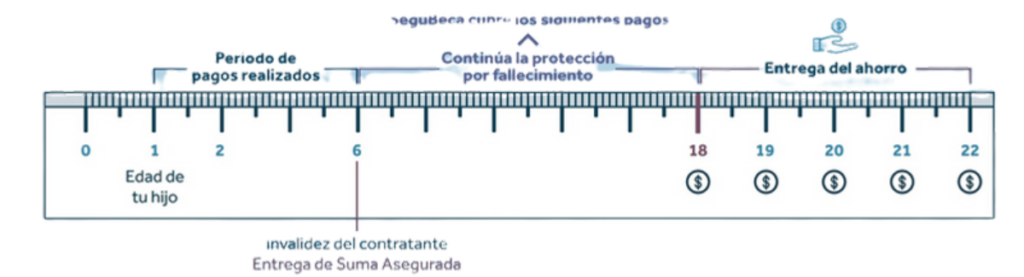

In case of disability

In case of contracting Disability coverage, the trust covers the remaining premiums to be paid.

Payment of the Total and Permanent Disability Insured Amount: You will receive the Insured Amount you contracted for Disability in a single payment or in 24 monthly installments.

The capital amount that can be accumulated for the benefit of children for university can be created so that they can study both in Mexico and abroad.

The trust can be held in dollars, and in Mexico, in UDIs, a capital gains instrument that grows with inflation so that the money is guaranteed at its real value.

Why invest in UDIS?

For any investor, the main concern is to preserve the value of their money over time and overcome the effects of inflation. According to specialists, investing in Investment Units (UDIS) is presented as an attractive opportunity for those who seek to keep their capital safe in the long term.

From 1995 to 2024, UDIS grew by 726%, while the dollar grew by only 183%.

- In 1995 the value of UDI 1 peso

- In 2024 the UDI value will be 8.26 pesos

- If you had invested $1,000,000 pesos in UDI you would currently have $8,260,000 pesos

- If you had invested $1,000,000 pesos in dollars, you would currently have $2,740,863 pesos.

FREE BENEFITS INCLUDED IN THE PLAN

- Asset Protection: SeguBeca This benefit allows you to purchase another Life Insurance policy at the end of the plan, without any medical requirements.

- Life Support: In the event of a terminal illness diagnosis (myocardial infarction, cancer, stroke, or chronic kidney failure), 25% of the Insured Amount or $700,000 MXN, whichever is less, will be advanced.

- Medical Assistance Benefit: Provides a second medical opinion from authorized professionals in the U.S.A. on the diagnosis given to you in Mexico, regarding any of the conditions covered by the policy.

POINTS TO CONSIDER

- This trust is non-attachable, meaning that no matter what happens, the money allocated for your education will be secure and reserved exclusively to guarantee your access to college. If you don't complete your studies, the capital will return to you.

- You're not only ensuring their academic future, but also demonstrating a deep commitment to their well-being. This trust is your promise that you'll always be there to protect them and guide them toward their dreams, with nothing standing in their way.

- As a parent, your greatest desire is for their education to be not only quality, but also safe, no matter what circumstances life may present. Do you want to be sure that nothing can jeopardize your child's educational future?

- By establishing an educational trust, you protect the funds intended for your child's college education from any eventuality, including possible garnishments or future claims. This trust is non-attachable, meaning that no matter what happens, the money intended for their education will be secure and reserved exclusively to ensure their access to college.

Do you have any questions? Feel free to write to us.

Phone number

449 389 5796

449 241 6423

lps.lifeplanningsolutions@gmail.com

Visit us

Aguascalientes